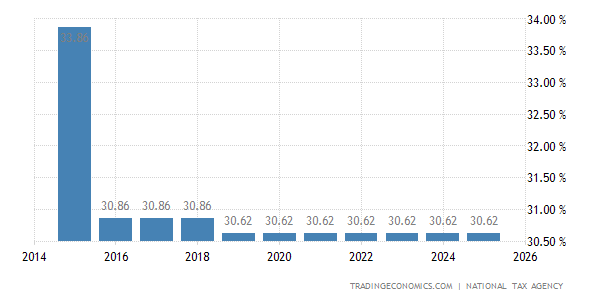

japan corporate tax rate 2018

The Corporate Tax Rate in Japan stands at 3226 percent. Income from 0 to 1950000.

April 1st Is No Joke For U S Workers

In the case that a.

. Corporate Tax Rate in Japan averaged 4296 percent from 1993 until 2016 reaching an all time high of 5240 percent. Final tax return Corporations are. Year Taxable Income Brackets Rates Notes.

The business year is. Tax rates The tax rate is 232. Ad Browse Discover Thousands of Business Investing Book Titles for Less.

Product Market Regulation 2018. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold. Corporate Tax Rate in Japan averaged 4296 percent from 1993 until 2016 reaching an all time high of 5240 percent.

Japan 255 255239 as from 1 April 2015 239234 as from 1 April 2016 234 234 232 as from 1 April 2018 Jersey 010 010 010 01020 01020 Jordan. Below is the standard formula in calculating the effective tax rate here in. An under-payment penalty is imposed at 10 to 15 of additional tax due.

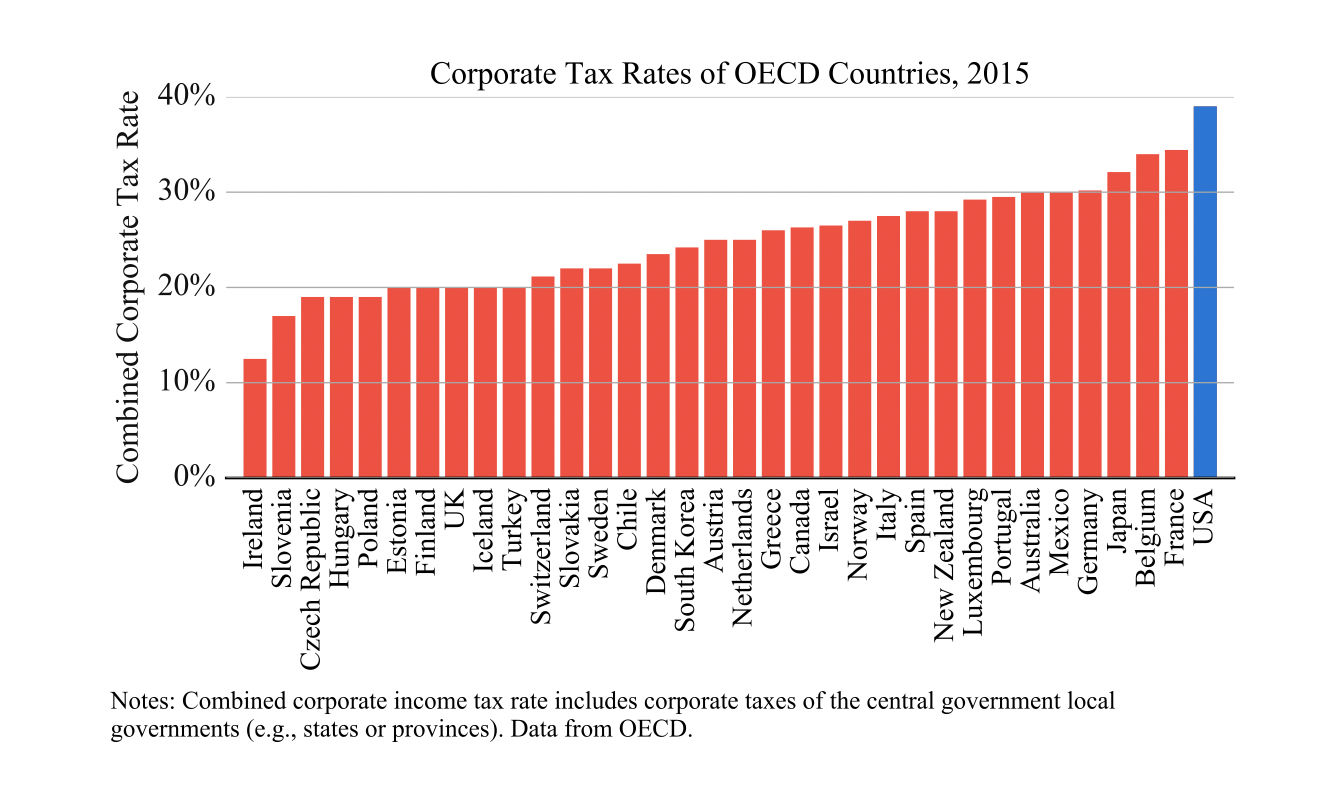

Details of Tax Revenue Japan. Due to a provision in. 1 2018 the corporate tax rate was changed from a tiered structure that staggered corporate tax rates based on company income to a flat rate of 21 for all companies.

Regulation in Network and Service Sectors 2018. Japan Income Tax Tables in 2018. Government at a Glance.

Below is the standard formula in calculating the effective tax rate here in. Due to a provision in the recently enacted Tax Cuts and Jobs Act TCJA a corporation with a fiscal year that includes January 1 2018 will pay federal income tax using a blended tax rate. The local standard corporate tax rate in.

The rate is increased to 10 to 15 once the tax audit notice is received. For a company with capital of 100 million or less a lower rate of 19 is applied to an annual income of 8 million or less. Business year A business year is the period over which the.

Corporate tax in Japan. Details of Tax Revenue Korea. The Corporate Tax Rate in Japan stands at 3226 percent.

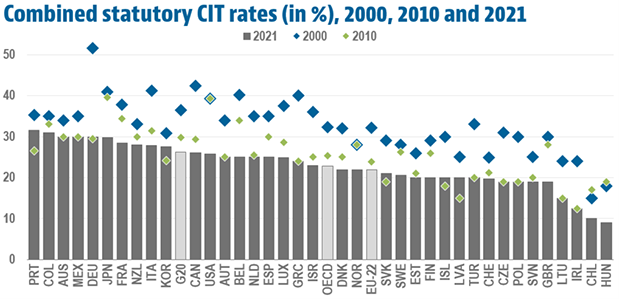

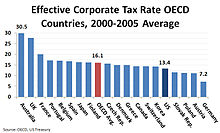

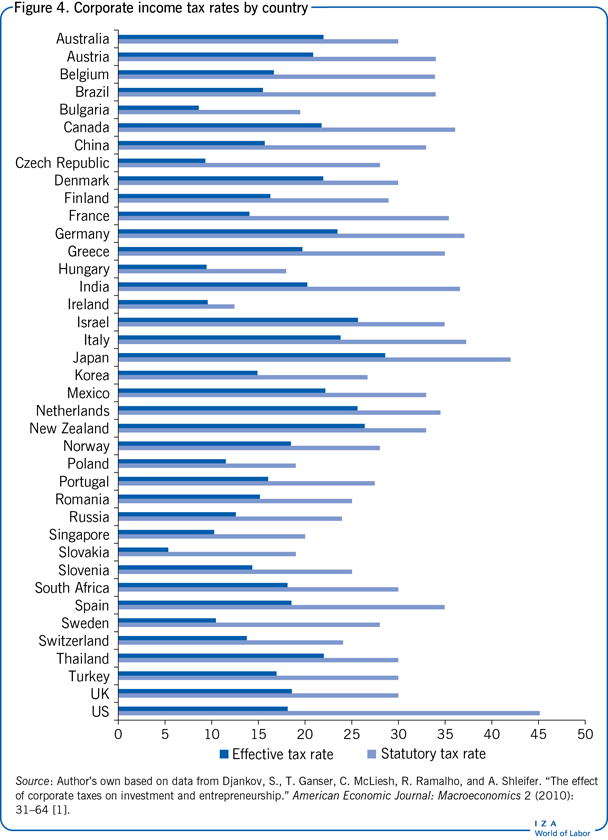

Tax Rate applicable to fiscal years beginning between 1 April 2016 and 31 March 2018. Effective Statutory Corporate Income Tax Rate. Separately from the national corporate tax companies registered in Japan are also subject to a local corporate residential tax payable to the local tax office where the company is registered.

Historical Federal Corporate Income Tax Rates and Brackets 1909 to 2020. The tax rate for small and medium-sized enterprises with the capital of 100 million yen or less is 15 for those with an annual income of 8 million yen or less and 234. Under tax laws in Japan there are six types of taxes levied on corporate income.

2018-2020 All taxable income. Income from 1950001 to.

Korea Faces Tax Dilemma Amid Slowdown

Personal Income Taxes In Canada Revenue Rates And Rationale Hillnotes

How Do Us Taxes Compare Internationally Tax Policy Center

Corporate Tax In The United States Wikipedia

Corporate Tax Rates Around The World Tax Foundation

Corporate Taxes Rates Down Revenues Up Cato At Liberty Blog

Corporate Tax Rates Around The World Tax Foundation

Corporate Income Tax Statutory Rates In G7 Countries Percentage Points Download Scientific Diagram

Corporate Tax Rates Around The World Tax Foundation

Six Economic Facts On International Corporate Taxation

Us Corporate Tax Rates Now Among The Lowest In The World Report The Fiscal Times

Iza World Of Labor Corporate Income Taxes And Entrepreneurship

How Important Is Tax Competition To India International Tax Review

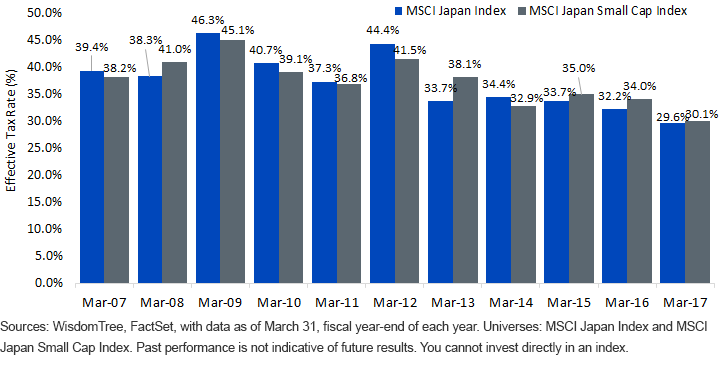

Corporate Tax Cuts Taking A Page From The Japanese Playbook Seeking Alpha

Data Shows Largest Firms Benefited Most From India S Corporate Tax Cuts

Corporate Tax Rates Around The World 2018 World Taxpayers Associations